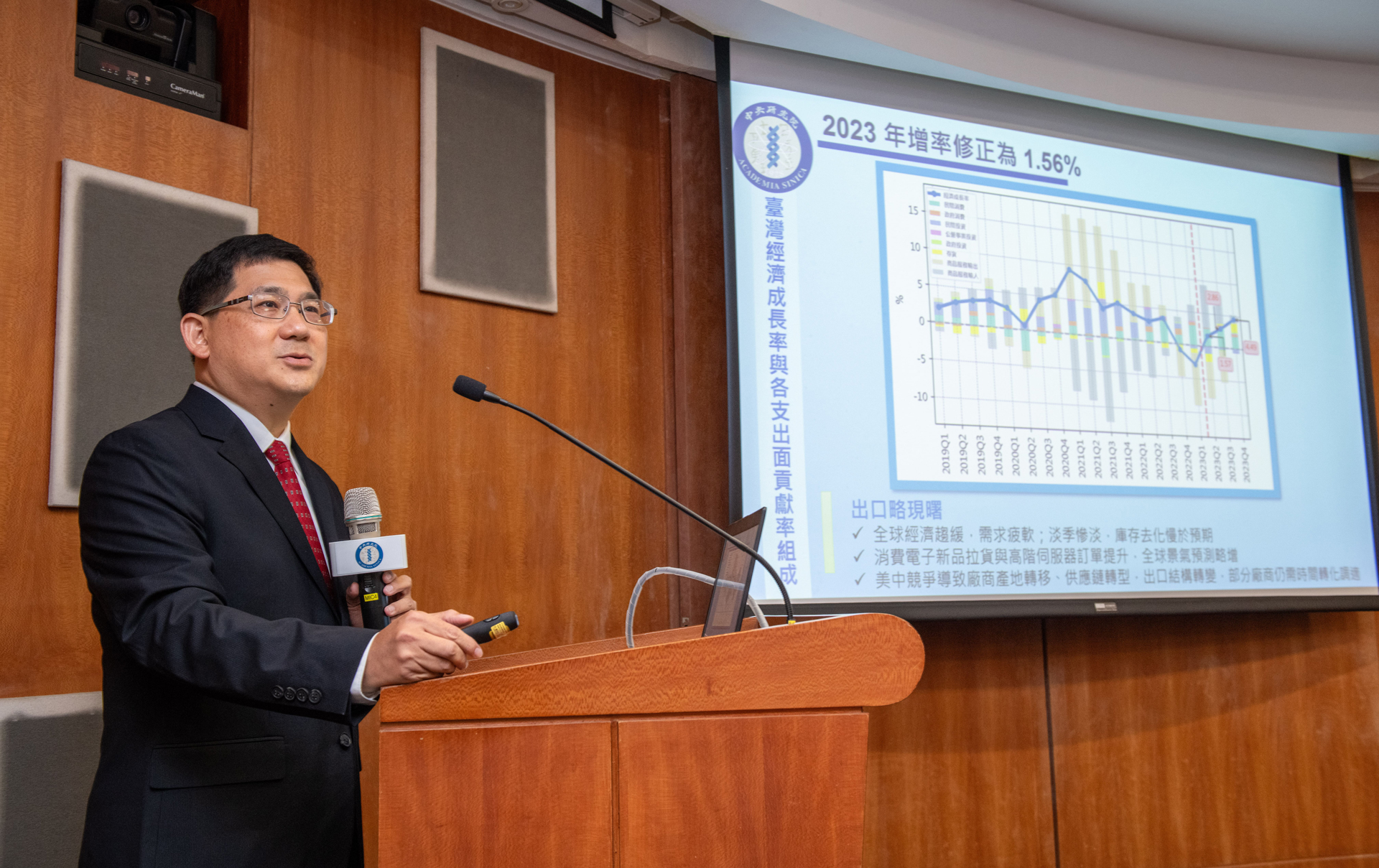

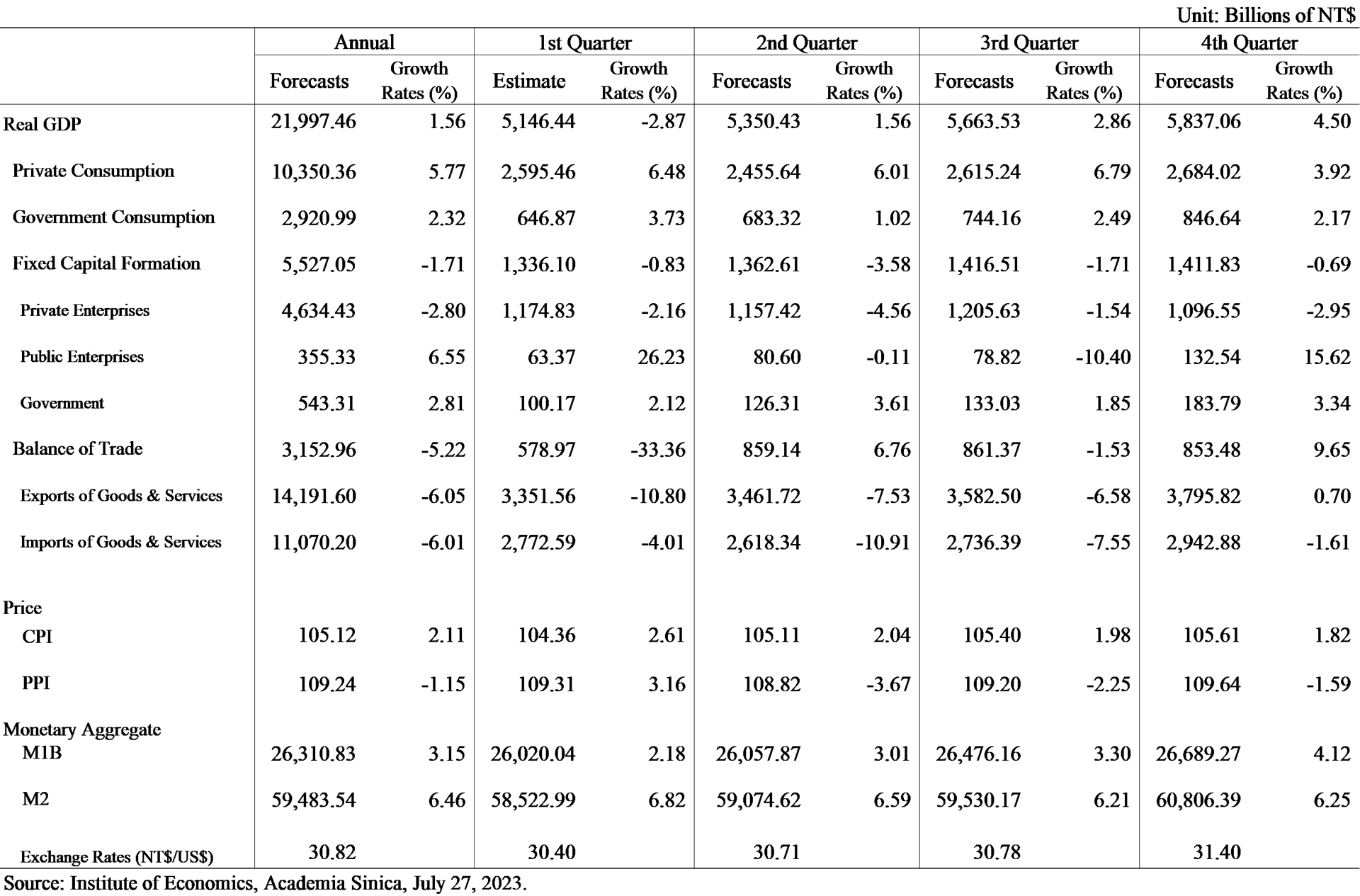

During the first half of 2023, major economies experienced the consequences of contractionary monetary policies to address inflation, resulting in a global economic slowdown and weakened demand. The ongoing inventory adjustment in the manufacturing sector negatively affected export orders and equipment investment in Taiwan. In the first quarter of 2023, the real GDP growth rate declined by 2.87%. Looking ahead, private consumption is expected to play a pivotal role in supporting economic growth in the second half of the year. External demand, however, remains constrained. As a result, we revise downward the projected real economic growth rate for 2023 to 1.56%.

The lifting of pandemic restrictions produced a significant upswing in private consumption, thereby boosting domestic demand. Real private consumption in the first quarter of 2023 witnessed a remarkable increase of 6.48%. This surge in demand was particularly pronounced in various service sectors, including dining, leisure, entertainment, and tourism. Over the first six months, the retail and catering industry experienced substantial growth with total turnovers rising by 8.99% and 26.27%, respectively, compared to the same period last year. Notably, the automotive and motorcycle industry, textile and apparel industry, and retail department stores all saw growth rates exceeding 10%. Moreover, the catering and group meal industry experienced exceptional growth of over 50%, largely due to the increase in air travel. The June consumer confidence index increased, bolstered by the government’s policy measures such as housing loan and rent subsidies, public transportation assistance, and energy-efficient appliance replacement subsidies. These measures have increased consumer disposable income. As borders continue to open, the number of cross-border travelers is expected to rise, further stimulating private consumption. As a result, steady growth in private consumption is projected for the second half of the year, with estimates indicating an overall increase of 5.77% in private consumption for all of 2023.

Private investment seemed cautious, evident from a decline of 2.16% in real private investment during the first quarter of 2023. This trend is pronounced in the manufacturing sector, where the domestic acquisition of fixed assets decreased by 3.24%, with a significant decline of 6.92% in miscellaneous machinery and equipment. Additionally, capital equipment imports decreased by 4.41% (in NTD or by 10.34% in USD) in the first half of the year. Amid a global economic outlook fraught with uncertainties, business investment demand is expected to be suppressed. After considering various factors, such as prices and high base period influences, private investment growth is estimated to reach -2.80% in 2023. Despite this conservative outlook on private investment, government and state-owned enterprises continue to invest, providing some support. Nonetheless, the overall fixed capital formation for 2023 is projected to decline by 1.71%.

The global demand for goods is currently sluggish, and there has been a noticeable deceleration in global trade growth. In the first quarter, the annual growth rates of real goods and services exports were -10.80% and -4.01%, respectively. Moreover, the nominal goods export in USD has exhibited negative growth for ten consecutive months, from September 2022 to June 2023. The first six months of this year saw exports and imports declined by 12.56% and 14.75% ( -18.05% and -20.04% in USD), respectively. Both information technology and traditional industries experienced a decrease in year-on-year growth rates of exports and imports during the first half of the year. Additionally, manufacturing inventory adjustment has been slower than initially anticipated, and export orders for June indicates a continued decline. Although there is an expectation that the decline in goods exports and imports in the second half of the year will be less severe than in the first half, and the service trade is predicted to gradually recover, the overall annual growth rate is still projected to remain negative. After considering the price factor, exports and imports of real goods and services in 2023 are projected to decrease by 6.05% and 6.01%, respectively.

Inflation has increased due to rising prices in food and entertainment services. On average, the consumer price index (CPI) during the first six months of 2023 rose by 2.32%, while the core CPI increased by 2.66% during the same period. In contrast, the producer price index (PPI) declined by 0.37% compared to the same period last year, influenced by a decline in raw material prices and exchange rate fluctuations. The downward trend in international commodity prices may halt the rising pattern of goods prices. On the other hand, the demand for services, particularly in the catering and entertainment sectors, remains robust. Considering these factors, it is projected that the CPI will increase by 2.11%, and the PPI will decline by 1.15% in 2023.

In the labor market, as the service industry has been flourishing, employment opportunities have improved. The average unemployment rate during the first six months of the year stood at 3.51%. However, the economic slowdown has adversely impacted the manufacturing sector, resulting in a rise in the number of employees on unpaid leave. According to the Ministry of Labor, the latest data as of July shows that the number of employees affected has reached 10,575, with the manufacturing sector contributing up to 80% of this figure, particularly in the metal and electrical machinery industry. Looking forward, the unemployment rate for all of 2023 is projected to be 3.58%.

In terms of monetary policy, the central bank has implemented a contractionary approach. The central bank raised three policy interest rates by 12.5 basis points. Over the first six months of the year, the annual growth rates of M1B and M2 were 2.60% and 6.71%, respectively. These growth rates are expected to slow down in 2023, compared to the approximately 7% in money supply in 2022. Specifically, M1B and M2 are projected to grow by 3.15% and 6.46%, respectively, in 2023.

Moving forward, the second half of 2023 is full of notable uncertainties and risks, associated with the ongoing global economic slowdown, which has a substantial impact on market demand. Key challenges include the complexities surrounding China’s economic recovery, the deferral effects on global consumption and investment caused by major economies’ implementation of contractionary monetary policies, and the potential fluctuations in commodity prices due to geopolitical risks. Considering all these factors, our forecast for real GDP growth has a 50% confidence interval of 0.52% to 2.76%. This wide range reflects the significant uncertainties at play and the potential for varying economic outcomes in the coming months.

▲Table 1 2023 Taiwan Economic Forecast: A Revision